Table of Contents

The Impact of Tariffs and Trade Wars on Small Businesses

Tariff-Induced Economic Slumps

Recessions and Small Business: What the Data Shows

Mitigating Risk: How to Save Your Small Business

Conclusion

Contributors

Tiny Manyonga

Contributor

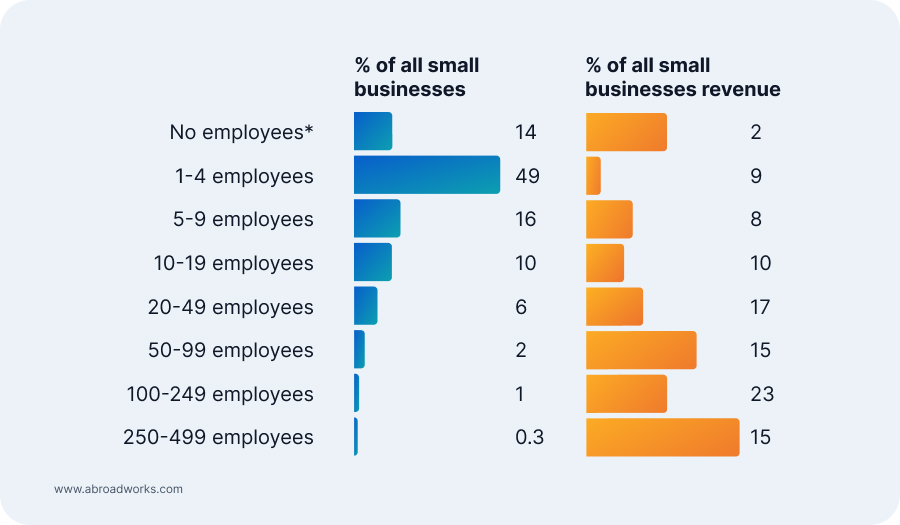

Small businesses are the largest group of employers in the US. Defined as any business with under 500 workers, the majority of employers with small businesses have fewer than 20 employees. Despite some having no employees at all, they employ some 61.7 million individuals. That is almost half (46.4%) of all private workers (U.S. Small Business Administration Office of Advocacy). This makes them the largest contributor to the US economy when compared to their medium and larger counterparts.

The Impact of Tariffs and Trade Wars on Small Businesses

Tariffs are taxes imposed on imported goods sold within the United States. If the US government imposes a tariff on certain goods, these tariffs are not paid by governments or businesses exporting to the US. Instead, these taxes are paid by American consumers. For example, a $200 iPhone, a quintessentially American product, will cost $240 in the US after the proposed 20% tariff because these are assembled in and imported from China (CNET).

The increase in the price of imported goods has a profound impact on the US domestic market. Over two-thirds of small to medium local businesses rely on imports for either production or as merchandise for distribution. When facing tariffs on essential imports, businesses are forced to pass the tax onto their consumers. Whereas larger corporations are in a better position to absorb some loss of business due to price hikes, smaller businesses face an existential threat as their smaller customer base dwindles. Not to mention, this creates cost-push inflation as prices tend to rise throughout the economy.

Impact of a trade war on small businesses

The impact is not limited to businesses relying on imports and operating in the domestic market. A trade war arises amid an economic dispute between two or more countries. In the case of tariffs, any country targeted by the US may respond by imposing tariffs on US goods exported to their shores. While the citizens of that country are the ones who pay the tariffs, US producers are still hurt. The higher cost of US goods and services abroad will result in lower demand in international markets. Local businesses essentially will lose at least some of their international customers.

A surprising number of small businesses produce locally and rely on exports of their goods. Small businesses make up 97% of businesses that export their goods, although they comprise only 35% of total exports by value (Office of Advocacy). This means that numerous small businesses tend to rely on smaller but much more frequent transactions with nations like Canada, Mexico, and China, our largest small business trading partners. These three countries stick out as they have recently been subject to tariffs from the current administration and announced retaliatory tariffs of their own. Unsurprisingly, small businesses are expected to struggle or even close down due to the political turbulence in the economy.

Tariff-Induced Economic Slumps

Recessions are a decline in economic activity lasting more than a few months. They are often a result of a combination of factors, and it is unclear if a trade war can lead to one. Regardless, the possibility of a tariff-induced economic slump in 2025 is increasing (CNBC). Recessions have varying degrees of severity according to regions. For example, southern states like Florida, Georgia, Mississippi, Alabama, and even California suffered the greatest economic losses during the Great Recession of 2008; while the northeastern states like Vermont, Connecticut, New Hampshire, and Maine had a softer landing (Reuters). As with tariffs, small businesses are also particularly vulnerable to economic slumps.

There are two major factors that account for why small businesses face a greater threat during a recession. Firstly, small businesses are highly unlikely to have a large market share. That is, they often exist in highly competitive markets where the margins for both profit and error tend to be low. In times of economic uncertainty and poor sales, due to recession, inflation, and other factors, small businesses are highly susceptible to failure (NY Fed). Larger businesses are not immune to the impact of recessions, but often have more wiggle room to absorb the impact due to a larger market share and higher profit margins.

The second major factor is the availability of credit. A drop in consumer spending coupled, in this case, with inflation and a tax rise (tariffs are taxes) may lead to a higher demand for credit as cash reserves dwindle while businesses try to stay afloat. A significant spike in inflation may also lead to the Federal Reserve increasing interest rates, the cost of credit. Larger private institutions tend to face less difficulty in acquiring credit (and even bailouts, as was the case in the Great Recession). Smaller businesses tend to have smaller assets and other forms of collateral. Tightened access to credit and adverse financial conditions mean that small businesses bear the brunt of economic and job losses and closures. This pattern is evident in previous recessions.

Recessions and Small Business: What the Data Shows

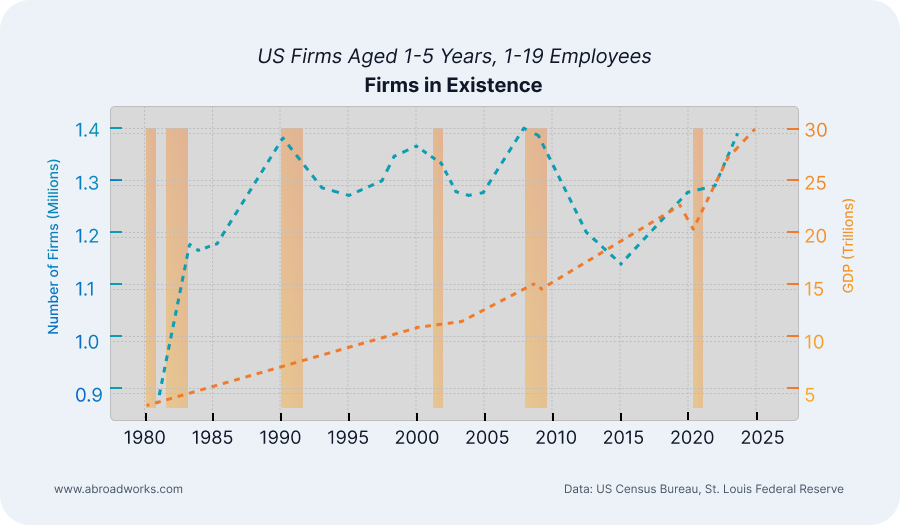

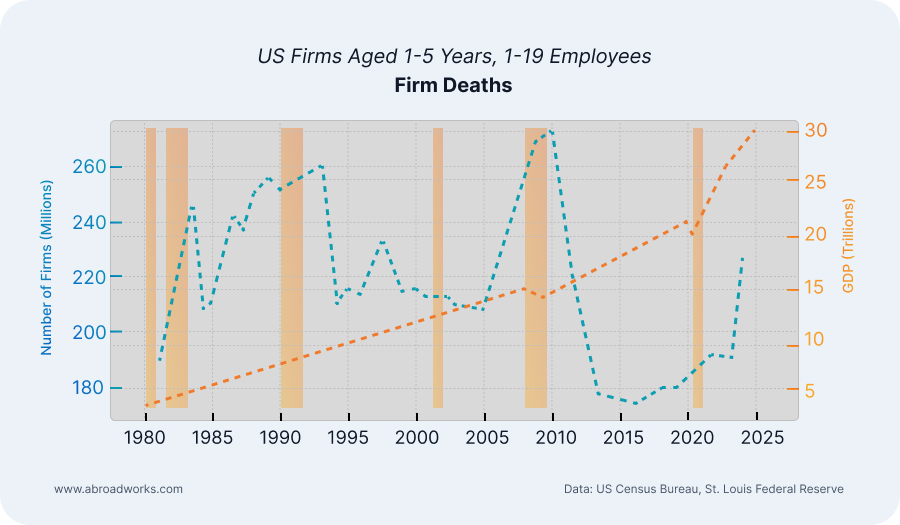

Impact of recessions on small and newly established businesses

The figure above focuses on small businesses in the US (under 20 employees) that have been in existence for 5 years or less as of the year the statistics were released. On the left are the number of firms in existence (top) and the number of firms that closed (bottom). On the right is the US GDP, and the years highlighted in red are the periods officially recognized as a recession by the Federal Reserve. A few notable trends appear.

- The number of new small businesses fluctuated over the years but has been relatively stable over the last 45 years.

- The largest slump was in the aftermath of the Great Recession, and that lasted about 5 years.

- Firm closures tend to spike when approaching and during recessions; the most notable spike being from 2005 to 2010.

- The pandemic had a delayed spike in business closures, most likely because of government relief funds and the expectation that the pandemic would not last. After the lifting of lockdowns and the cessation of PPP loan programs, there was another spike in business closures.

Mitigating Risk: How to Save Your Small Business

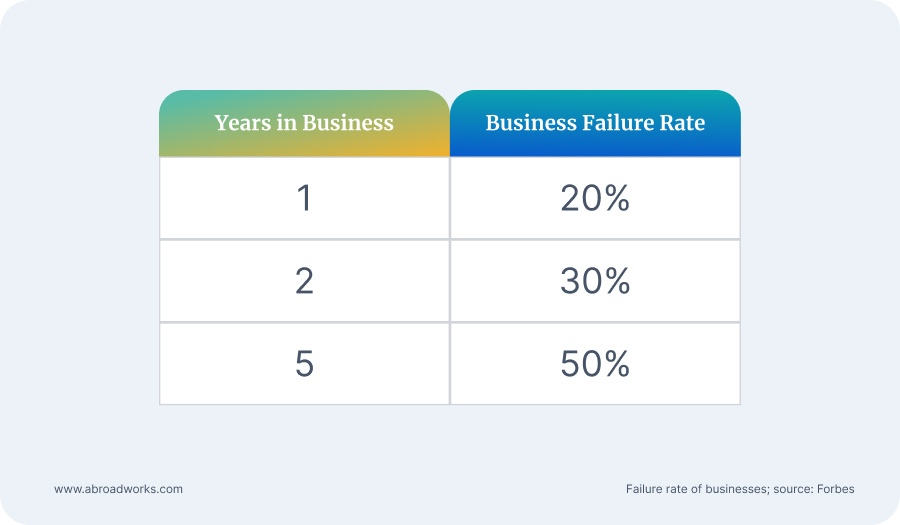

Every small business owner faces different market conditions and pressures. Yet, certain themes are common to all new business owners. According to Forbes, about 1 in 5 businesses fail in the first year, and that rate rises to half within 5 years. This is commonly due to either a lack of capital or a lack of market. Depending on the severity of a potential recession and the economic conditions, the failure rate is likely to rise in the course of this and the following years.

Every small business owner faces different market conditions and pressures. Yet, certain themes are common to all new business owners. According to Forbes, about 1 in 5 businesses fail in the first year, and that rate rises to half within 5 years. This is commonly due to either a lack of capital or a lack of market. Depending on the severity of a potential recession and the economic conditions, the failure rate is likely to rise in the course of this and the following years.

Addressing the most common reasons for failure is a balancing act during a potential economic slump. Raising capital in a high-interest environment when financial institutions are tightening credit can be a herculean task. It is paramount to carefully manage available cash reserves. On the other hand, creating a market often means spending money on marketing campaigns and creating demand for your goods or services. A combination of solutions to consider includes reducing the cost of essential business expenses that are needlessly high while employing effective marketing strategies at a sustainable budget. Below are a couple of suggestions to address the two most common causes of business failure.

1. Hiring Philosophy

Unsurprisingly, labor is the most significant cost for small businesses, followed by inventory. According to Forbes, labor costs can make up 70% of a business’s spending. One positive outcome in the business world that resulted from the pandemic is the advancement of remote work technology. In a recession, there are job losses and an increase in unemployment. Naturally, it is expected that the unemployment rate will go up and wage demands will go down. However, this refers to real wages, that is, the value of wages in the face of the current cost of living. In an inflationary environment coupled with economic uncertainty and the constant threat of tariffs, the actual dollar amount of wages in the US is likely to rise.

However, as it stands, this is a regional economic phenomenon. Higher tariffs and the resultant cost inflation are (at least for now) limited to the US and its major trading partners. Instead of absorbing nominal wage hikes and eating into cash reserves, it would be more prudent to consider offshore hiring for remote-capable roles in your business. Highly qualified professionals are often available at a fraction of US costs.

2. Do Not Neglect Marketing

All business owners know that they ignore marketing at risk of their own peril. Among the most critical stages of a small business is the leap from being a sole proprietor in a localized market and trying to make the leap to being a state-wide or even nationwide brand. Social media has been instrumental in propelling many small businesses from being a one-man band to a larger entity. However, this is a leap that cannot be taken alone, and finding the right persons to assist with this leap can be a life-or-death decision for the business.

According to Forbes, 1 in 3 small businesses do not have a website, spend about 9% of their revenue on marketing, and yet, the lack of market need is the second most common reason small businesses fail. A full-time marketing professional may be too costly for a small business, but there are seasoned marketing professionals across the world capable of elevating your brand without committing your cash reserves during adverse financial environments.

3. Underutilized Resource Management

Among the most significant issues discussed are the unavailability of credit in economic slumps. While some businesses tend to furlough or lay-off employees to save cash, this is often not an option for most small businesses. Over 60% of small businesses have less than 5 employees, and each employee is often critical to the operation or survival of the business. In cases where releasing employees is not a possibility, business owners must consider other ways to save cash.

Consider any resources that are underutilized in the business. The most obvious places to start are the business’s assets, including vehicles, buildings, storage space, or machinery. Any assets that can be used to generate an alternative revenue source must be considered. One could collaborate with other small businesses to provide transportation services with an underused truck or rent out additional storage space, for example. However, one asset often overlooked is the business owner themselves.

4. Time and Talent Management

Owners often wear many hats in their business. They are the CEO who also manages operations, maintains the financial records, is responsible for business development, and carries out HR/payroll functions. Arguably, the most important role for a business owner is to grow the business and identify new opportunities. But instead of working on the business, many owners find themselves working in the business. Less time dedicated to expanding the business’s market, income streams, or improving supplier networks means that your business is unlikely to survive economic turbulence.

As a business owner, spend more time working on the business, rather than in it or putting out fires. Repetitive tasks, including responding to customers, accounting and bookkeeping, and other day-to-day activities, can be delegated to personal assistants or other skilled workers. Personal assistants, accountants, marketing, and other specialized employees can be hired on an hourly basis, and most can work remotely. If you have a business partner or on-site employee, then evaluate their time use and talent. An on-site employee may have the skills required to expand the business, create networking opportunities, research new markets, or identify improvements in the supply chain. However, if they are spending their time on menial tasks, this could be potential or talent wasted.

Conclusion

The tariff policy is uncertain at the moment. It is unclear, unlikely for some, if a recession will follow in 2025 or 2026. Regardless, businesses fail all the time. Over 230,000 businesses failed in just 2023 alone. A traditional approach to business does not guarantee success, and in an economic environment with restricted access to credit, using cash, assets, and human resources can be the difference between life and death for your business. Spend more time building the business, extract the maximum value of your assets, and use the talent at your disposal to their fullest potential. For routine remote-capable tasks, consider hourly wage offshore employees, as there is a significant labor cost differential.